Distribution Transformer Market by Mounting (Pad, Pole, Underground), Phase (Three and Single), Power Rating (Up to 0.5 MVA, 0.5-2.5 MVA, 2.5-10 MVA, Above 10 MVA), Insulation(Oil Immersed, Dry), End User and Region - Global Forecast to 2029

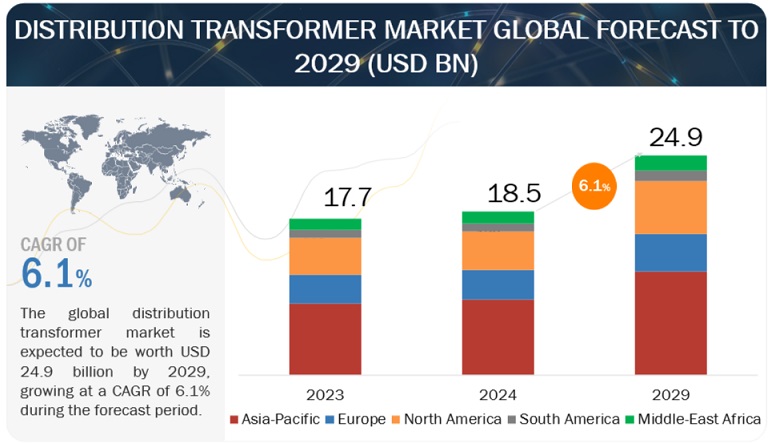

[265 Pages Report] The global distribution transformer market is estimated at USD 18.5 billion in 2024, with a projected growth to USD 24.9 billion by 2029, exhibiting a Compound Annual Growth Rate (CAGR) of 6.1%. The global distribution transformer is witnessing significant growth due to focus on grid modernization and rising investments in grid infrastructure worldwide. The evolution of traditional distribution transformers into intelligent devices, known as "smart transformers," marks a significant technological advancement. Equipped with sensors, communication capabilities, and data processing functionalities, these smart transformers collect real-time data on grid performance, identify potential issues, and optimize power flow. Integration with smart grid technologies enhances power delivery efficiency and reliability, minimizing energy losses and improving grid stability. Smart transformers enable continuous monitoring of their health and performance, facilitating predictive maintenance practices. Utilities can detect potential issues early, schedule maintenance preemptively, and minimize downtime, thereby reducing maintenance costs and enhancing grid reliability. Digital technologies are revolutionizing the distribution transformer market. Manufacturers leverage digital tools for design optimization, production automation, and quality control. Utilities employ digital platforms for data analysis and grid management, leading to more efficient operations and decision-making.

The adoption of dry-type transformers is gaining momentum due to growing environmental concerns. These transformers eliminate fire risks and environmental hazards associated with liquid-immersed transformers. Manufacturers explore the use of biodegradable or recyclable materials in transformer components, reducing their environmental impact. There's a growing focus on developing and deploying energy-efficient distribution transformers to minimize energy losses during power conversion. Government regulations and incentive programs promote the adoption of advanced models, reducing energy consumption and carbon emissions. Manufacturers consider the entire life cycle of distribution transformers to minimize environmental impact. Sustainable materials and end-of-life recycling options are explored to ensure eco-friendly practices throughout the product lifecycle.

Government initiatives and international efforts to expand electrification in developing regions drive demand for distribution transformers, particularly in Asia Pacific, Middle East & Africa, and Latin America. Aging infrastructure replacement in developed countries and ongoing infrastructure expansion projects globally further fuel market growth. The growing need to modernize electricity grids worldwide drives investments in advanced distribution transformers capable of handling modern grid complexities, integrating renewable energy sources, and accommodating evolving energy demands. Established global players like Hitachi Energy, Siemens, and Schneider Electric dominate the distribution transformer market. Regional players with expertise in specific voltage standards and regional requirements contribute significantly to market competition and innovation. Therefore, the distribution transformer market is witnessing dynamic growth driven by technological advancements, environmental considerations, global infrastructure initiatives, and a focus on grid modernization. By embracing innovation, sustainability, and regional expertise, manufacturers can capitalize on emerging opportunities in the market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Distribution Transformer Market Dynamics

Driver: Growing demand for reliable power

The surging demand for reliable power is a critical driver propelling the distribution transformer market forward. A thriving global economy is synonymous with a growing demand for electricity. As industries expand and production processes become more automated, the need for reliable power becomes paramount. Distribution transformers play a crucial role in efficiently delivering electricity to these industrial facilities, ensuring smooth operations and minimizing disruptions. The rapid urbanization trend worldwide translates to a growing concentration of people and businesses in cities. This urbanization necessitates the development of robust power infrastructure, including efficient distribution networks. Distribution transformers form the backbone of these networks, ensuring reliable power delivery to high-rise buildings, commercial complexes, and residential areas. Our lives are becoming increasingly reliant on technology, and this reliance translates to a dependence on reliable electricity.

Data centers, communication networks, and even household appliances all require a steady flow of power. Distribution transformers play a vital role in ensuring uninterrupted electricity supply for these technology-driven applications. Reliable power is no longer a luxury; it's considered essential for improved living standards. Access to electricity allows for essential appliances, lighting, and communication technologies, contributing to better quality of life. In developing regions, expanding electrification efforts with reliable power delivery necessitate a growing number of distribution transformers. Therefore, the relentless pursuit of reliable power across industries, communities, and individuals fuels the growth of the distribution transformer market. As our dependence on electricity continues to rise, efficient and reliable distribution transformers will be a crucial component in ensuring a stable and prosperous futures.

Restraints: High initial investment costs

High initial investment costs associated with distribution transformers pose a significant restraint on the growth of this market. Distribution transformers utilize various raw materials like steel, copper, and insulating fluids. Fluctuations in the prices of these materials can significantly impact the overall cost of a transformer. Manufacturers need to strike a balance between using high-quality materials for durability and efficiency, while keeping costs competitive. Distribution transformers, particularly high-capacity models, involve complex manufacturing processes. This complexity can translate to higher labor costs, specialized equipment requirements, and stringent quality control measures. Streamlining production processes while maintaining quality is crucial for manufacturers to manage their costs.

The growing demand for smart transformers equipped with sensors, communication modules, and advanced functionalities adds to the initial investment cost. These features require additional components, sophisticated engineering, and integration with communication networks, all of which contribute to a higher price tag. Developing regions with a large population lacking access to electricity often have limited budgets for infrastructure projects. The high initial cost of distribution transformers can be a barrier to expanding electrification efforts in these areas. Utilities and businesses face pressure to keep overall costs down, including capital expenditures. The high upfront cost of distribution transformers can be a deterrent, especially when compared to the lower initial cost of older, less-efficient models. As technological advancements drive down costs, financing options become more accessible, and life cycle cost analysis gains traction, the impact of this restraint is expected to lessen over time. This will pave the way for a more robust and efficient distribution transformer market, contributing to a reliable and sustainable power infrastructure globally.

Opportunities: Smart grid integration

The integration of smart grid technologies with distribution transformers presents a significant opportunity for growth and innovation in the global distribution transformer market. Smart transformers equipped with sensors can collect real-time data on voltage fluctuations, current flow, and transformer health. This data allows for proactive management of the grid, enabling utilities to identify potential problems before they occur, optimize power flow, and minimize energy losses. By acting on real-time data, smart transformers contribute to a more efficient and reliable power grid. Smart transformers can provide valuable insights into their own performance and operating conditions. These insights can be used for predictive maintenance practices, allowing utilities to schedule maintenance based on actual need rather than following a predetermined schedule. This proactive approach minimizes downtime, reduces maintenance costs, and extends the lifespan of transformers.

Smart grids with integrated communication networks can utilize data from smart transformers to identify and localize faults within the grid. This allows for automated responses, such as isolating affected areas to minimize outages and rerouting power flow to maintain service to unaffected areas. These self-healing capabilities contribute to a more resilient grid infrastructure that can withstand disruptions and provide uninterrupted power supply. The rise of renewable energy sources like solar and wind power presents challenges for grid management due to the intermittent nature of these resources. Smart transformers with bi-directional power flow capabilities can help integrate renewables into the grid by managing the flow of power from both traditional sources and renewable sources. This fosters a more sustainable and efficient power grid. Smart grids with integrated smart transformers can facilitate demand-side management programs. These programs encourage consumers to adjust their electricity consumption during peak hours, potentially through dynamic pricing schemes or automated controls. Smart transformers can provide data on consumer demand patterns, allowing utilities to implement effective demand-side management strategies.

Challenges: Cybersecurity threats

The growing integration of smart technologies within distribution transformers presents a double-edged sword. While smart transformers offer significant benefits for grid management and efficiency, they also introduce new cybersecurity threats that pose a challenge for the distribution transformer market. Traditional transformers were relatively isolated from cyber threats. However, smart transformers equipped with sensors, communication modules, and internet connectivity create a larger attack surface for potential cyberattacks. Hackers could exploit vulnerabilities in these systems to gain unauthorized access, disrupt grid operations, or even cause physical damage to transformers. Smart transformers collect and transmit a wealth of data on grid performance, energy consumption patterns, and transformer health. This valuable data needs robust security measures to prevent breaches. If compromised, this data could be used for malicious purposes, such as manipulating energy prices or disrupting critical infrastructure. A successful cyberattack on a single smart transformer could have cascading effects throughout the grid. This could lead to widespread power outages, damage to critical infrastructure, and economic disruptions.

The interconnected nature of smart grids amplifies the potential consequences of a cyberattack. The utilities and grid operators responsible for managing smart transformers might not have the necessary expertise or resources to adequately address cybersecurity threats. This lack of skilled personnel can leave them vulnerable to sophisticated cyberattacks. Cybersecurity threats are constantly evolving, with hackers developing new techniques and exploiting new vulnerabilities. The distribution transformer market needs to be constantly adapting and implementing robust security measures to stay ahead of these evolving threats. Cybersecurity threats pose a significant challenge to the distribution transformer market. However, by implementing robust security measures, fostering collaboration, and investing in cybersecurity expertise, the industry can navigate these challenges and ensure the safe and reliable operation of smart grid technologies. As cybersecurity becomes an integral part of transformer design, operation, and management, the distribution transformer market can move forward with confidence, unlocking the full potential of smart grid integration for a more efficient and sustainable energy future.

Distribution Transformer Market Ecosystem

The market for distribution transformers is marked by the participation of leading companies that are firmly established, financially robust, and possess substantial expertise in the production of distribution transformers. These companies hold a significant market presence and provide a wide array of product offerings. They harness advanced technologies and maintain extensive global sales and marketing networks. Among the notable players in this market are Hitachi Energy Ltd. (Switzerland), Eaton Corporation (Ireland), Schneider Electric (France), Siemens Energy (Germany), Toshiba Energy Systems & Solutions Corporation (Japan), Mitsubishi Electric Corporation (Japan), Hyosung Heavy Industries Co., Ltd. (South Korea), Crompton Greaves Ltd. (India), CG Power and Industrial Solution Ltd. (India), and Hammond Power Solutions (Canada).

Oil Immersed segment, by insulation, to have the largest market share during forecast period.

The oil-immersed segment dominates the distribution transformer market for insulation due to a confluence of factors that make it a reliable, well-established, and cost-effective solution for a wide range of applications. Oil-immersed transformers have been around for over a century, with a well-documented track record of reliable operation. The insulating oil provides efficient cooling by transferring heat away from the transformer core and windings, preventing overheating and extending the lifespan of the equipment. This long history of proven performance and reliability makes oil-immersed transformers a trusted choice for utilities and industrial users.

Compared to some newer insulation technologies, oil-immersed transformers offer a more cost-competitive solution. The materials used are readily available, and the manufacturing processes are well-established, leading to lower production costs. Additionally, the maintenance requirements for oil-filled transformers are generally simpler and less expensive compared to some alternative options. Oil-immersed transformers come in a wide range of sizes and voltage ratings, catering to diverse application needs. They can be effectively deployed in various environments, from urban distribution networks to remote industrial facilities. This versatility allows them to be a suitable solution for a broad spectrum of customers in the distribution transformer market.

While concerns regarding fire safety have historically been associated with oil-immersed transformers, advancements have been made to mitigate these risks. Modern transformer oils have higher flash points and self-extinguishing properties, reducing the likelihood of fires. Additionally, safety features like conservators and pressure relief valves can further enhance fire safety. Utilities and maintenance personnel possess extensive experience and expertise in working with oil-filled transformers. This readily available skilled workforce facilitates easier installation, operation, and maintenance of these transformers, compared to newer technologies that might require specialized training or infrastructure adjustments.

Three phase segment, by phase, to emerge as largest segment of distribution transformer market.

The three-phase segment reigns supreme in the distribution transformer market by phase segment for several compelling reasons. These factors highlight the crucial role three-phase transformers play in efficiently delivering power to various applications. Many industrial facilities, factories, and large commercial buildings require significant amounts of power. Three-phase transformers excel at handling these higher power demands. Their design allows them to efficiently convert three-phase incoming power into usable single-phase or three-phase voltage levels for various industrial equipment and machinery. This efficient handling of higher power loads makes them the preferred choice for these industrial applications.

For applications requiring high power capacity, three-phase transformers offer a more cost-effective solution compared to multiple single-phase transformers. A single three-phase unit can handle the equivalent power of three single-phase transformers, reducing overall equipment costs, installation complexity, and footprint requirements. This economic advantage makes them a compelling choice for high-power distribution needs. Three-phase transformers boast superior efficiency compared to their single-phase counterparts. This translates to lower energy losses during power transmission and distribution. As energy efficiency becomes a growing priority, the lower energy losses associated with three-phase transformers make them an attractive option for utilities and businesses striving to reduce their environmental footprint and operational costs. Three-phase power distribution systems are the dominant standard globally. Utilities and electrical professionals possess extensive experience and knowledge in working with three-phase transformers. This established infrastructure and familiarity with the technology streamline installation, operation, and maintenance processes compared to potentially less familiar single-phase solutions.

Three-phase transformers offer inherent scalability for power distribution networks. A single three-phase transformer can feed multiple single-phase circuits, catering to diverse loads within a facility or distribution network. This flexibility allows for efficient power delivery to various applications within a single system. For large-scale power distribution and industrial applications, the advantages of three-phase transformers are undeniable. Their ability to handle higher power loads, cost-effectiveness, improved efficiency, established infrastructure, and inherent scalability solidify their position as the dominant segment in the distribution transformer market..

Utilites segment, by End User, to hold the largest market share in distribution transformer market.

The utilities segment reigns supreme in the global distribution transformer market by end user segment, driven by several key factors that highlight their crucial role in electricity delivery. Electricity utilities are responsible for managing vast distribution networks that span across cities, towns, and rural areas. These networks require a significant number of distribution transformers to efficiently step down voltage from transmission lines to usable levels for homes, businesses, and industries. The sheer scale of these distribution networks necessitates a large and ongoing demand for distribution transformers from the utilities segment.

Aging infrastructure and the need for grid modernization are driving significant investments from utilities in upgrading and expanding their distribution networks. This modernization effort includes replacing outdated transformers with newer, more efficient models. This focus on grid modernization translates to a substantial demand for distribution transformers from the utilities segment. Utilities prioritize reliable and efficient power delivery to their customers. Modern distribution transformers equipped with smart functionalities and advanced monitoring capabilities align well with this objective. These transformers allow for real-time data collection, enabling utilities to identify potential problems, optimize power flow, and minimize outages. This focus on reliability and efficiency fuels demand for advanced distribution transformers within the utilities segment.

Governments and regulatory bodies are increasingly implementing regulations and incentive programs promoting energy efficiency and grid modernization. These initiatives often encourage utilities to adopt advanced distribution transformers, further driving demand within this segment. Distribution transformers are long-term assets with lifespans exceeding several decades. Utilities require reliable and efficient transformers to ensure the smooth operation of their distribution networks. The long-term nature of these investments and the focus on asset management solidify the leading position of the utilities segment in the distribution transformer market. The dominance of the utilities segment in the global distribution transformer market is expected to continue. The ongoing need for grid modernization, the focus on reliability and efficiency, and the long-term asset management requirements of utilities will continue to drive significant demand for distribution transformers within this segment. As the market evolves, manufacturers might cater to the specific needs of utilities by developing advanced transformer solutions that support grid modernization efforts and promote a more sustainable and efficient power distribution infrastructure..

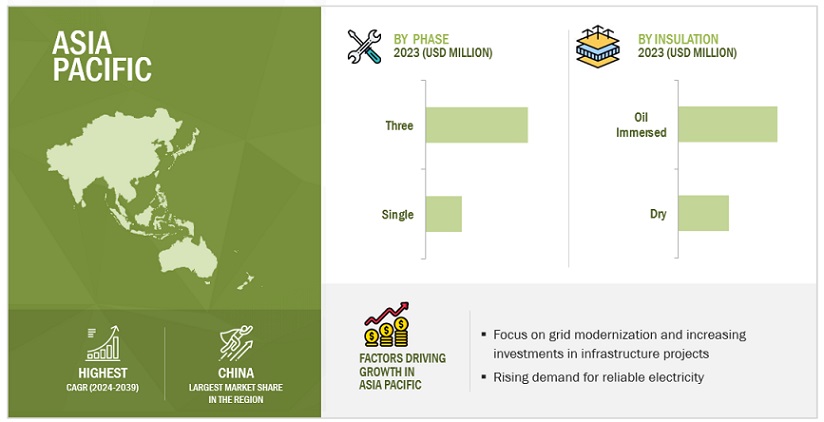

The Asia Pacific marine engines market is poised to achieve the highest CAGR throughout the forecast period.

The Asia Pacific region emerges as the frontrunner in the global distribution transformer market, driven by a confluence of factors that create a robust demand environment. The Asia Pacific region is experiencing rapid urbanization, with a growing concentration of people in cities. This urbanization fuels the development of new infrastructure, including residential buildings, commercial complexes, and industrial facilities. All these developments necessitate a significant expansion of electricity distribution networks, requiring a vast number of distribution transformers.

Several countries in the Asia Pacific region boast strong economic growth and expanding industrial sectors. These industries require reliable and efficient power supply, translating to a high demand for distribution transformers to step down voltage levels and cater to the power needs of various industrial processes and machinery. Several developing countries within the region are striving to expand access to electricity for their populations. Government initiatives and infrastructure projects aimed at rural electrification necessitate the deployment of numerous distribution transformers to deliver power to remote areas. Manufacturers in the region are increasingly focusing on developing cost-effective distribution transformer solutions. This caters to the budget constraints of some utilities in developing economies, further driving market growth in the Asia Pacific region.

The growing urbanization trend and focus on electrification in rural areas often involve catering to a large number of individual consumers. This translates to a demand for smaller capacity distribution transformers suitable for residential and low-power commercial applications. The dominance of the Asia Pacific region in the global distribution transformer market is expected to continue in the foreseeable future. The ongoing urbanization, economic growth, infrastructure development, and government electrification initiatives will continue to fuel demand for transformers. Manufacturers that can cater to the specific needs of the region, including cost-effectiveness, smaller capacity transformers, and functionalities for renewable energy integration, will be well-positioned to capitalize on this dynamic and growing market..

Key Market Players

Hitachi Energy Ltd. (Switzerland), Eaton Corporation (Ireland), Schneider Electric (France), Siemens Energy (Germany), Toshiba Energy Systems & Solutions Corporation (Japan), Mitsubishi Electric Corporation (Japan), Hyosung Heavy Industries Co., Ltd. (South Korea), CG Power and Industrial Solution Ltd. (India) and several others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market Size available for years |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Mounting, By Phase, By Power Range, By Insulation, By End User |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East and Africa, and South America |

|

Companies covered |

Hitachi Energy Ltd. (Switzerland), Eaton Corporation (Ireland), Schneider Electric (France), Siemens Energy (Germany), Toshiba Energy Systems & Solutions Corporation (Japan), Mitsubishi Electric Corporation (Japan), Hyosung Heavy Industries Co., Ltd. (South Korea), CG Power and Industrial Solution Ltd. (India), and Hammond Power Solutions (Canada). |

The distribution transformer market is classified in this research report based on mounting, phase, power range, insulation, end user, and region.

Based on mounting, the distribution transformer market has been segmented as follows:

- Pad

- Pole

- Underground

Based on phase, the distribution transformer market has been segmented as follows:

- Three

- Single

Based on power range, the distribution transformer market has been segmented as follows:

- Up to 0.5 MVA

- 0.5-2.5 MVA

- 2.5-10 MVA

- Above 10 MVA

Based on insulation, the distribution transformer market has been segmented as follows:

- Oil Immersed

- Dry

Based on end user, the distribution transformer market has been segmented as follows:

- Power Utilities

- Residential & Commercial

- Industrial

Based on regions, the distribution transformer market has been segmented as follows:

- North America

- Asia Pacific

- South America

- Europe

- Middle East and Africa

Recent Developments

- In February 2024, Siemens Energy inaugurated its first Siemens Energy Transformer production facility in the US, delivering vital infrastructure to enable the country’s energy transition.

- In April 2023, Eaton announced it has completed the acquisition of a 49% stake in Jiangsu Ryan Electrical Co. Ltd. (Ryan), a manufacturer of power distribution and sub-transmission transformers in China.

- In June 2022, Hitachi Energy, a market and technology leader in transmission, distribution, and grid automation solutions, and Schneider Electric announced that they have entered a collaboration to provide excellent customer value and accelerate the energy transition..

Frequently Asked Questions (FAQ):

What is the current size of the global distribution transformer market?

The global distribution transformer market is estimated to be USD 18.5 billion in 2024.

What are the major challenges for distribution transformer market?

The distribution transformer market faces several challenges despite its promising future. High initial investment costs can be a barrier for some utilities, particularly in developing regions. Cybersecurity threats are on the rise as smart transformers become more prevalent. Additionally, stricter environmental regulations regarding oil disposal necessitate lifecycle management considerations for oil-immersed transformers, the current market leader. Mitigating these challenges through cost-effective solutions, robust cybersecurity measures, and eco-friendly practices will be crucial for the sustained growth of this vital market.

Which phase has the largest market share in the distribution transformer market?

Three-phase reigns supreme in the distribution transformer market due to its ability to efficiently handle high power loads. They're the cost-effective choice for industrial applications and large buildings, boasting superior efficiency, established infrastructure for easy maintenance, and inherent scalability to power diverse loads within a single system.

Which region holds second largest market share in the distribution transformer market?

North America holds the second largest market share in distribution transformers due to a combination of factors: aging infrastructure needing replacement, focus on grid modernization and efficiency, economic growth driving industrial demand, and a growing renewable energy sector requiring transformer integration. This creates a robust market for both traditional and advanced distribution transformer solutions.

Which is the largest segment, by insulation in the distribution transformer market during the forecast period?

Oil-immersed transformers dominate the market due to their proven track record, cost-effectiveness, versatility, and established infrastructure. They offer reliable operation, efficient cooling, and come in various sizes for diverse applications. While concerns about fire safety exist, advancements have mitigated risks, and the readily available workforce skilled in oil-filled transformers makes them the current leader. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

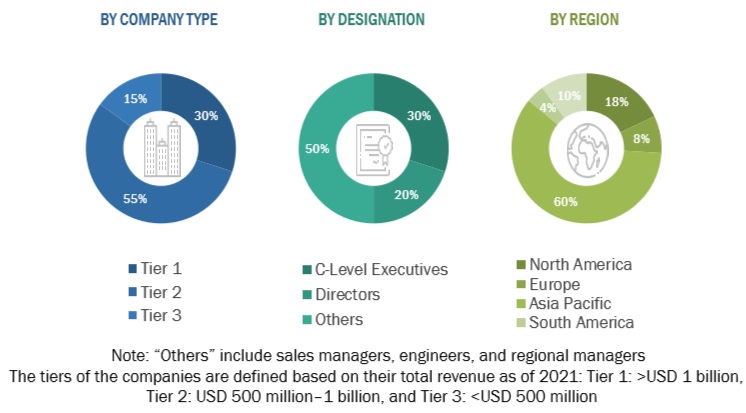

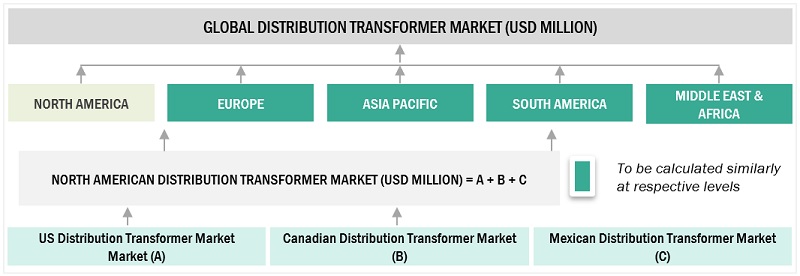

This study encompassed significant efforts in determining the present size of the distribution transformer market. It commenced with a thorough secondary research process to gather data related to the market, similar markets, and the overarching industry. Subsequently, these findings, assumptions, and market size calculations were rigorously validated by consulting industry experts across the entire supply chain through primary research. The total market size was assessed by conducting an analysis specific to each country. Following that, the market was further dissected, and the data was cross-referenced to estimate the size of various segments and sub-segments within the market.

Secondary Research

In this research study, a wide range of secondary sources were utilized, including directories, databases, and reputable references such as Hoover's, Bloomberg BusinessWeek, Factiva, World Bank, International Monetary Fund (IMF), the US Department of Energy (DOE), and the International Energy Agency (IEA). These sources played a crucial role in gathering valuable data for a comprehensive analysis of the global distribution transformer market, covering technical, market-oriented, and commercial aspects. Additional secondary sources included annual reports, press releases, investor presentations, whitepapers, authoritative publications, articles authored by well-respected experts, information from industry associations, trade directories, and various database resources.

Primary Research

The distribution transformer market involves a range of stakeholders, including raw material suppliers, component manufacturers, distribution transformer manufacturers/assemblers, distributors, end users, and post-sale services within the supply chain. The demand for this market is primarily driven by end users such as power utilities, residential & commercial. On the supply side, there is a notable trend of heightened demand for contracts from the industrial sector and a significant presence of investments and expansions among major players.

To gather qualitative and quantitative insights, various primary sources from both the supply and demand sides of the market were interviewed. The following breakdown presents the primary respondents involved in the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The estimation and validation of the distribution transformer market size have been conducted using a bottom-up approach. This approach was rigorously employed to ascertain the dimensions of multiple subsegments within the market. The research process comprises the following key stages.

In this method, the production statistics for each type of distribution transformer have been examined at both the country and regional levels.

Thorough secondary and primary research has been conducted to gain a comprehensive understanding of the global market landscape for various segments of distribution transformer.

Numerous primary interviews have been undertaken with key experts in the field of distribution transformer development, encompassing important OEMs and Tier I suppliers.

When calculating and forecasting the market size, qualitative factors such as market drivers, limitations, opportunities, and challenges have been taken into account.

Global Distribution Transformer Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The process of determining the overall market size involved the methodologies described earlier, followed by segmenting the market into multiple segments and subsegments. To finalize the comprehensive market analysis and obtain precise statistics for each market segment and subsegment, data triangulation and market segmentation techniques were applied, as appropriate. Data triangulation was accomplished by examining various factors and trends from both the demand and supply perspectives within the ecosystem of the distribution transformer market.

Market Definition

Distribution transformers are a specialized type of electrical transformer engineered to lower the voltage of electricity from medium or high voltage transmission lines to the lower voltage levels required in distribution networks. These networks directly supply electricity to end users, including residential homes, commercial establishments, and industrial facilities. Typically, distribution transformers operate with a primary voltage below 35 kilovolts (kV) and provide a secondary voltage suitable for end-user applications, typically ranging from 240 volts (V) to 480V. Their primary role is to ensure the safe and efficient transmission of electrical power by reducing the voltage to levels suitable for use. Distribution transformers are integral components of the power distribution infrastructure, serving as the crucial link between the high-voltage transmission network and the low-voltage distribution network that serves individual consumers.

Key Stakeholders

- Government & research organizations

- Institutional investors

- Investors/shareholders

- Environmental research institutes

- Manufacturers’ associations

- Distribution transformer raw material and component manufacturers

- Distribution transformer manufacturers, dealers, and suppliers

- State and national regulatory authorities

- Manufacturing industry

- Energy efficiency consultancies

- Smart grid project developers

- Public & private power generation, transmission & distribution companies (utilities)

- Sub-station equipment manufacturing companies

Objectives of the Study

- To describe and forecast the distribution transformer market, in terms of value, by phase, power rating, mounting, insulation, end user, and region

- To forecast the market for various segments, in terms of value, with regard to five regions: North America, South America, Europe, Asia Pacific, and the Middle East & Africa, along with their key countries

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges, influencing the market’s growth

- To strategically analyze the subsegments with respect to individual growth trends, prospects, and contributions of each segment to the overall market size

- To study the complete supply chain and allied industry segments and perform a supply chain analysis of the distribution transformer landscape

- To strategically analyze the regulatory landscape, tariff, standards, patents, Porter’s five forces, import and export scenarios, trade values, and case studies pertaining to the market under study

- To analyze the opportunities in the market for various stakeholders by identifying the high-growth segments of the distribution transformer market

- To profile the key players and comprehensively analyze their market position in terms of ranking and core competencies1, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as agreements, partnerships, product launches, acquisitions, contracts, expansions, and investments in the distribution transformer market

Available Customization

With the given market data, MarketsandMarkets offers customizations based on the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players (up to 5)l

Growth opportunities and latent adjacency in Distribution Transformer Market